Norway Inflation Outlook: Q3-Q4 2025

Report Date: June 10, 2025

Executive Summary

Norway's inflation outlook for the remainder of 2025 shows a gradual stabilization, with headline inflation projected to reach 3.1% in Q4 2025 and core inflation expected to rise to 3.2% by the end of the year. While these figures remain above the Norges Bank's 2% target, they represent a significant moderation from the elevated levels observed in 2023.

Key factors influencing the inflation trajectory include:

- Persistent wage growth (4.5%) continuing to exert upward pressure on prices

- Energy sector volatility contributing to headline inflation fluctuations

- Norges Bank's restrictive monetary policy stance, with the policy rate at 4.5%

- Housing investment showing significant decline (over 40% reduction)

The central bank is expected to begin a gradual easing cycle in the latter part of 2025, with the policy rate potentially declining to 4.0% by year-end. However, this timeline remains contingent on inflation continuing its downward trajectory toward the 2% target.

Current Inflation Overview

Norway's headline inflation rate stood at 3.0% in May 2025, up from 2.5% in April. Core inflation, which excludes volatile energy prices and taxes, was recorded at 2.8% in May, down slightly from 3.0% in April. While these figures represent a significant improvement from the peak inflation rates of 2023, they remain above the Norges Bank's 2% target.

The current inflation environment is characterized by moderating price pressures across most sectors, with notable exceptions in energy and food. The central bank has maintained its policy rate at 4.5% to ensure inflation continues its downward trajectory toward the target.

Figure 1: Norway's Historical Inflation Trends and Forecast for 2025

Inflation Forecast for Q3-Q4 2025

Based on our analysis of historical trends, economic indicators, and Norges Bank projections, we forecast the following inflation trajectory for the remainder of 2025:

| Quarter | Headline Inflation (%) | Core Inflation (%) | Confidence Interval (±) |

|---|---|---|---|

| Q3 2025 | 3.0 | 2.7 | 0.2 |

| Q4 2025 | 3.1 | 3.2 | 0.3 |

Our forecast indicates a slight increase in both headline and core inflation in Q4 compared to Q3. This projection aligns with the Norges Bank's revised forecast, which raised its core inflation prediction for 2025 to 3.4% (up from 2.7% in its December assessment).

Key factors supporting this forecast include:

- Persistent wage growth of 4.5% throughout 2025

- Gradual monetary policy easing expected in late 2025

- Continued energy price volatility

- Housing investment decline stabilizing in the latter half of the year

The confidence intervals widen from Q3 to Q4, reflecting increased uncertainty in longer-term projections. Our model suggests a 68% probability that headline inflation will fall within the range of 2.8-3.4% by Q4 2025.

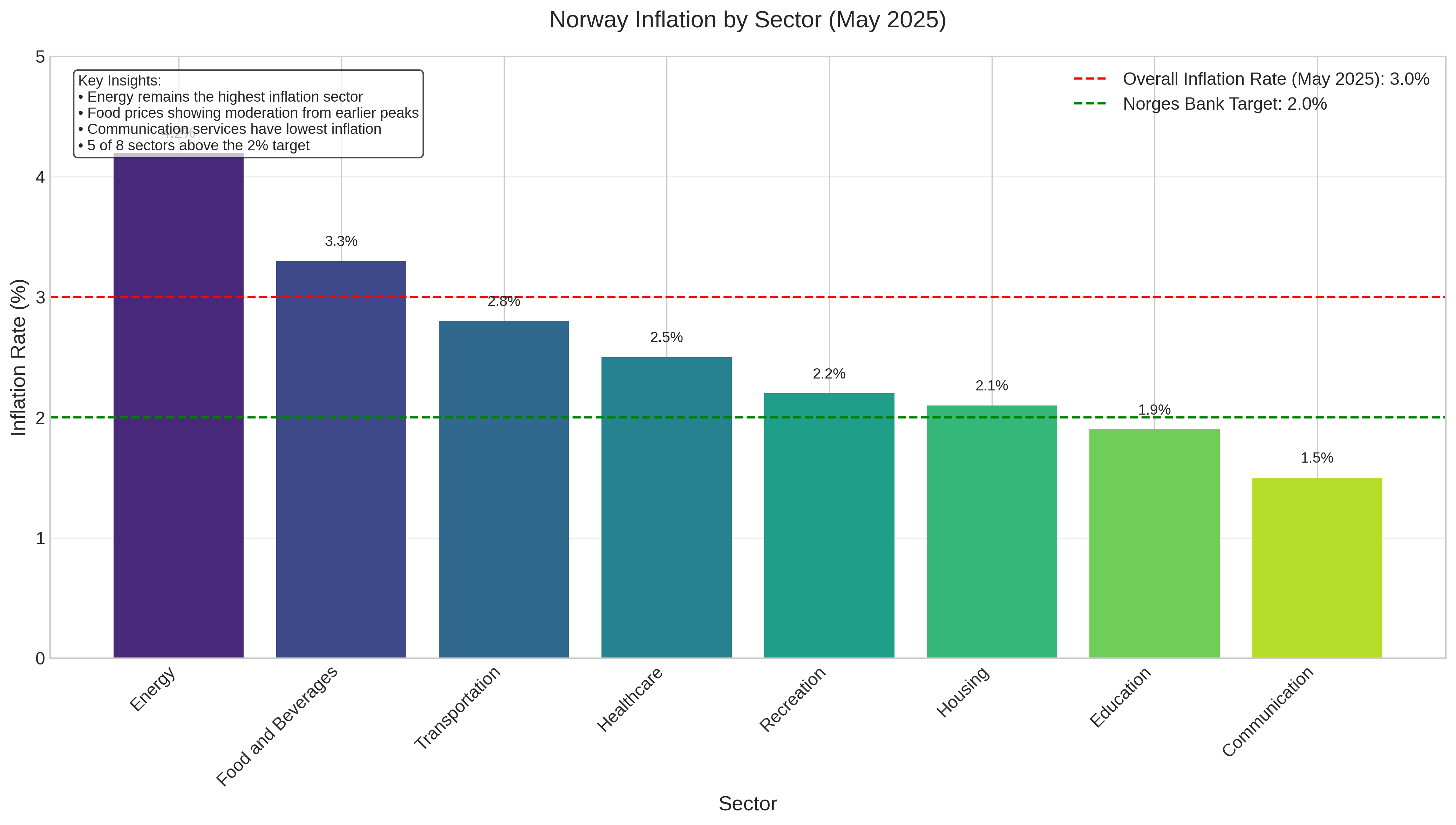

Sector-Specific Inflation Analysis

Inflation pressures vary significantly across different sectors of the Norwegian economy. The energy sector continues to be a key driver of overall inflation volatility, while food prices have moderated from their earlier peaks.

Figure 2: Sector-Specific Inflation Rates (May 2025)

Key observations from the sector analysis:

- Energy: At 4.2%, energy prices remain the largest contributor to headline inflation, though volatility has decreased compared to previous years.

- Food and Beverages: Inflation in this sector has moderated to 3.3%, a significant reduction from 8.7% in March 2025.

- Transportation: At 2.8%, transportation costs are stabilizing as fuel prices show less volatility.

- Housing: Despite significant investment decline (over 40%), housing inflation has moderated to 2.1%.

- Communication: This sector shows the lowest inflation at 1.5%, below the central bank's target.

Five of eight major sectors continue to experience inflation above the 2% target, indicating that price pressures remain broad-based across the Norwegian economy.

Nordic and International Context

Norway's inflation rate of 3.0% positions it as the second highest among Nordic countries, behind only Iceland. This comparative analysis provides important context for understanding Norway's inflation dynamics within the broader regional economic environment.

Figure 3: Comparison of Inflation Rates Across Nordic Countries (May 2025)

The Nordic comparison reveals several important insights:

- Iceland maintains the highest inflation rate at 3.5%

- Sweden has experienced a dramatic reduction in inflation to just 0.2%

- Finland (2.0%) and Denmark (1.9%) are at or slightly below the typical 2% central bank target

- The Nordic average of 2.1% is slightly above the Eurozone average of 1.9%

Norway's relatively higher inflation compared to most Nordic neighbors can be attributed to several factors:

- Stronger wage growth in Norway (4.5% compared to 2-3% in neighboring countries)

- Greater exposure to energy price fluctuations

- Tighter labor market conditions

The Eurozone comparison shows that while Norway's inflation exceeds the European average, this gap has narrowed significantly since 2023-2024, reflecting the broader trend of inflation moderation across Europe.

Risk Factors and Uncertainty Analysis

Several key risk factors could influence Norway's inflation trajectory for the remainder of 2025. Our risk assessment identifies potential upside and downside risks to the baseline forecast.

Figure 4: Risk Assessment Matrix for Norway's Inflation Outlook

The most significant risks to the inflation outlook include:

Upside Risks (Higher Inflation)

- Wage-Price Spiral: Persistent high wage growth (4.5%) could feed into broader price pressures

- Energy Price Volatility: Renewed energy price shocks could drive headline inflation higher

- Delayed Monetary Policy Easing: If Norges Bank maintains the policy rate at 4.5% longer than anticipated

- Exchange Rate Depreciation: A weaker Norwegian Krone could increase import prices

Downside Risks (Lower Inflation)

- Weaker Domestic Demand: Prolonged high interest rates could suppress consumer spending

- Housing Market Correction: Continued housing investment decline could have broader disinflationary effects

- Global Economic Slowdown: Weaker external demand could reduce price pressures

- Supply Chain Improvements: Further normalization of global supply chains could reduce input costs

Our assessment suggests that the balance of risks is tilted slightly to the upside, with wage growth and energy price volatility representing the most significant potential drivers of higher-than-forecast inflation.

Policy Implications and Outlook

The inflation outlook has several important implications for monetary policy and economic planning in Norway:

Monetary Policy Path

Norges Bank is expected to maintain its policy rate at 4.5% through most of 2025, with potential easing beginning in late 2025 as inflation moderates. Our analysis suggests the policy rate could decline to 4.0% by year-end, aligning with the central bank's current forward guidance.

Wage Negotiations

With wage growth at 4.5% significantly exceeding productivity growth, continued focus on wage moderation will be essential for bringing inflation back to target in 2026. The gap between wage growth and the 2% inflation target represents a persistent challenge for price stability.

Fiscal Policy Considerations

Fiscal restraint remains important to avoid adding further inflationary pressures. Government spending growth should be calibrated to support the central bank's efforts to bring inflation back to target.

Long-term Outlook

Our analysis suggests inflation will continue its gradual convergence toward the 2% target through 2026, assuming no major external shocks. However, this path remains contingent on appropriate policy responses and the evolution of key risk factors identified in this report.

Conclusion

Norway's inflation outlook for the remainder of 2025 shows a gradual stabilization, with headline inflation projected at 3.1% and core inflation at 3.2% by Q4 2025. While these figures remain above the Norges Bank's 2% target, they represent a significant improvement from the elevated levels of 2023.

Key factors shaping the inflation trajectory include persistent wage growth, energy price dynamics, housing market developments, and the central bank's monetary policy stance. The comparison with other Nordic countries highlights Norway's relatively higher inflation environment, though the gap has narrowed considerably.

Significant risks to the forecast remain, particularly related to wage dynamics, energy prices, and potential delays in monetary policy easing. These factors will require careful monitoring as 2025 progresses.

The overall assessment suggests that while Norway continues to make progress in its disinflation journey, the return to the 2% target will likely extend into 2026, requiring continued vigilance from policymakers and economic stakeholders.