Executive Summary

Argeo ASA (XOSL: ARGEO) is a subsea service provider specializing in marine robotics and digital solutions for offshore industries. The company operates across oil & gas, marine minerals, and renewables sectors, providing technical solutions combining vessels, advanced AUVs, sensors, and digital imaging technologies.

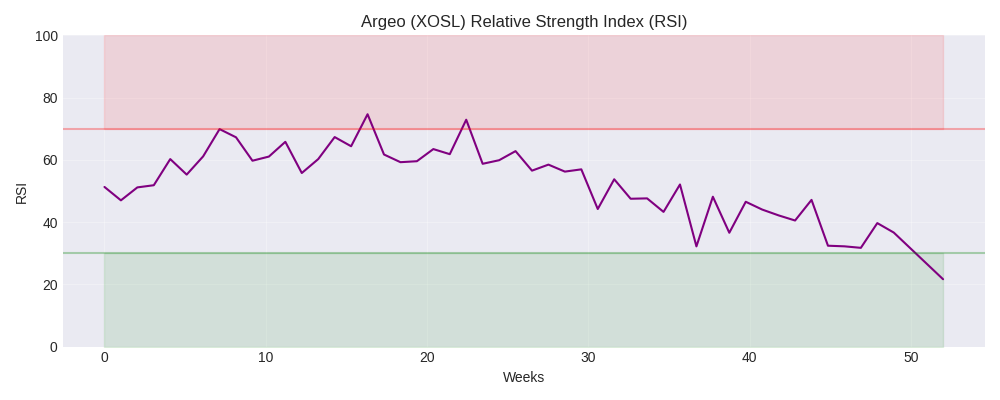

Key Investment Thesis: Argeo presents a high-risk, potentially high-reward investment opportunity. The company shows strong revenue growth and operates in expanding markets with significant technological advantages. However, ongoing profitability challenges, negative cash flow, and recent stock price weakness present substantial risks. The current price near 52-week lows and oversold technical indicators suggest a potential value opportunity for investors with appropriate risk tolerance and medium to long-term investment horizons. A staged entry approach with strict risk management is recommended given the mixed signals across financial, technical, and market factors.

Company Profile

Company Overview

Business Model

Argeo provides advanced subsea services using robotics and digital solutions for marine and offshore environments. The company specializes in underwater inspections, marine surveys, and data acquisition for various industries.

Revenue Streams

['Oil and Gas services (primary revenue stream, approximately 83% of revenues)', 'Renewables (14% of revenues, growing footprint in offshore wind)', 'Equipment rentals (3% of revenues)']

Target Markets

['Oil and Gas industry', 'Offshore Wind and Renewables', 'Marine Minerals exploration', 'Subsea infrastructure inspection']

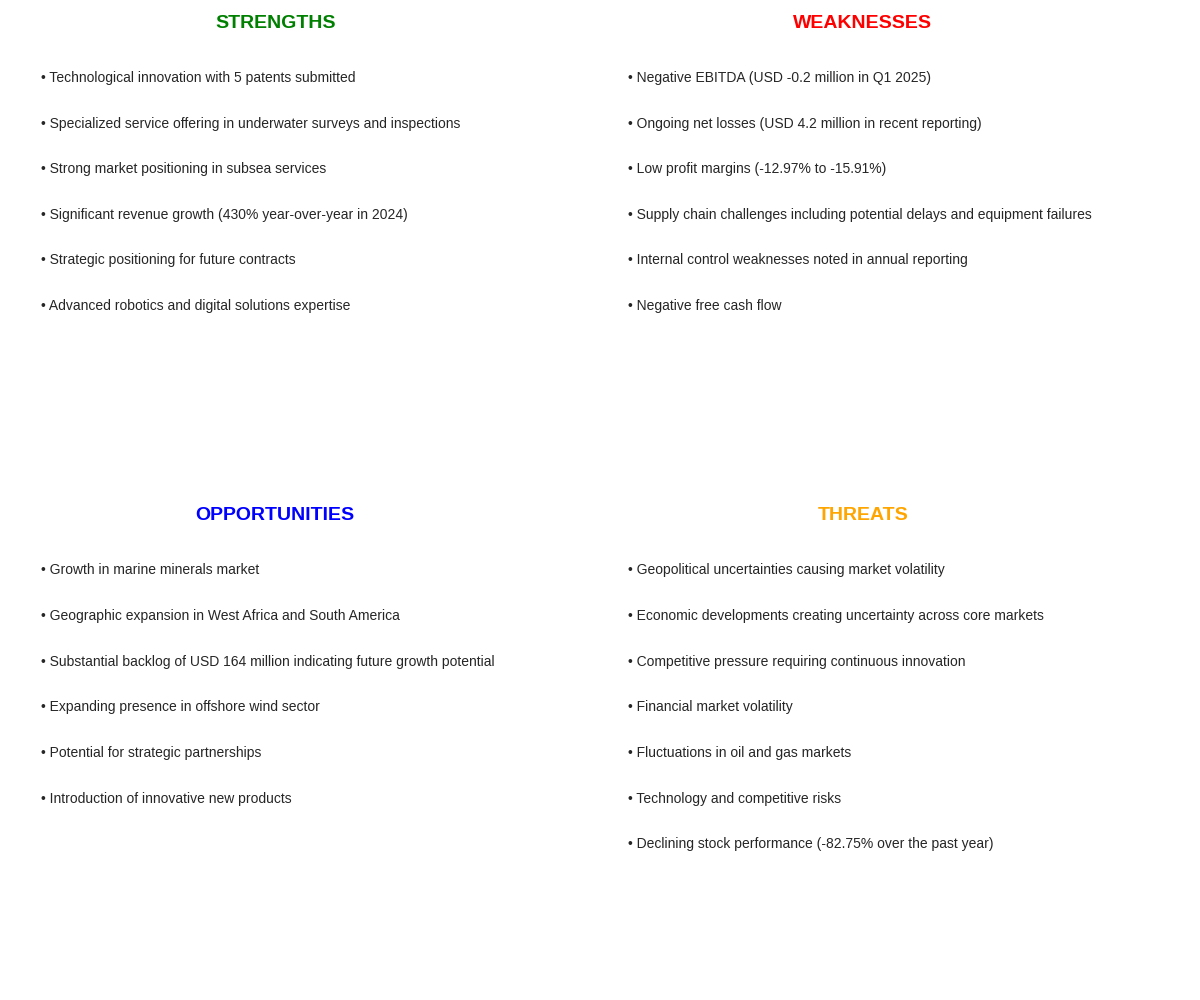

SWOT Analysis

Key Projects

| Project | Status | Significance |

|---|---|---|

| RWE Canopy Offshore Wind Project Initial site investigation survey for RWE's Canopy offshore wind project in Northern California |

Ongoing (as of June 17, 2024) | Demonstrates Argeo's expansion into renewable energy projects and marine exploration |

| Unmanned Surface Vehicle (USV) Services Launch of 'Argus' USV platform in collaboration with Maritime Robotics for advanced mapping and inspection services |

Active | Reduces fossil surface vessel use by up to 99%, advancing sustainable marine operations |

| South America IMR Contract Potential 4-year Inspection, Maintenance, and Repair contract in South America |

In preparation | Strategic positioning for long-term revenue stability |

Financial Analysis

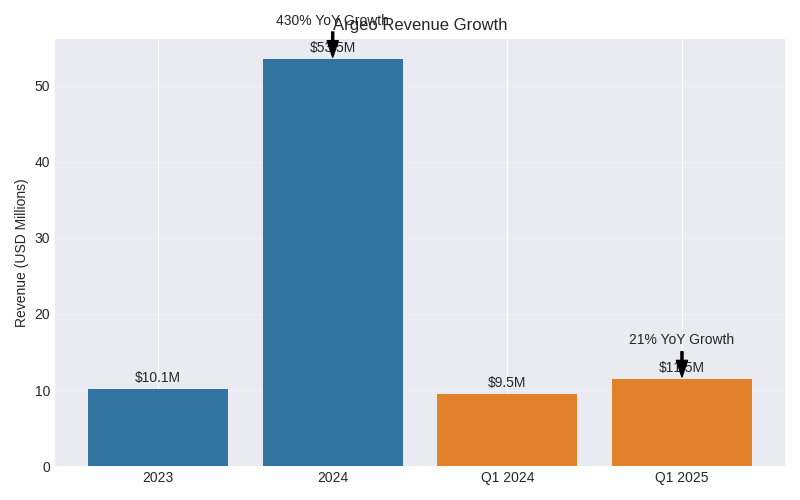

Revenue Growth

Financial Health Indicators

| Metric | Value | Assessment |

|---|---|---|

| Revenue | USD 53.5 million (2024, up from USD 10.1 million in 2023) | 430% year-over-year (Strong upward trend with Q1 2025 revenue at USD 11.5 million (21% increase from Q1 2024)) |

| Profit Margins | Gross: Not specifically provided in search results Operating: Negative (EBITDA of USD -0.2 million in Q1 2025) Net: -12.97% to -15.91% (varies by source) |

Negative margins indicating profitability challenges |

| Debt Levels | Total Debt: USD 15.5 million to USD 21.0 million (varies by source) Debt-to-Equity: 36% to 63.8% (varies by source) |

Volatile debt and liability levels with total liabilities at USD 57.2 million in Q1 2025 (decreased from USD 66.4 million at end of 2024) |

| Cash Flow | Operating: 40.41 million (recent 12-month period), but noted as negative in some recent periods Free Cash Flow: Consistently negative, ranging from approximately -US$29.514 million to -US$32,848.80 |

Negative cash flows suggest the company is in a growth or investment-intensive phase with substantial capital expenditures (-211.35 million in last 12 months) |

| Valuation Ratios | P/E: Trailing P/E: 2.29 - 3.56, Forward P/E: 3.56 P/S: 0.23 - 0.43 (compared to peer average of 2.7x) P/B: 0.40 - 0.70 |

Low valuation multiples compared to peers |

Recent Developments

-

June 17, 2024 - RWE Canopy Offshore Wind Project Selection

Argeo was selected to conduct the initial site investigation survey for RWE's Canopy offshore wind project in Northern California

Impact: Demonstrates the company's growing involvement in renewable energy and marine exploration projects -

October 21, 2024 - Strategic Equipment Transaction

Completed a USD 13 million transaction involving divestment of non-strategic equipment with a sale-leaseback strategy

Impact: Optimized asset management and improved financial flexibility -

February 12, 2025 - Private Placement

Raised NOK 150 million through private placement

Impact: Financing for equipment acquisitions and support for general corporate objectives -

April 2025 - Leadership Change

Trond F. Crantz stepped down as CEO, with Joost Bakker appointed as Interim CEO

Impact: Transition in executive leadership potentially affecting strategic direction

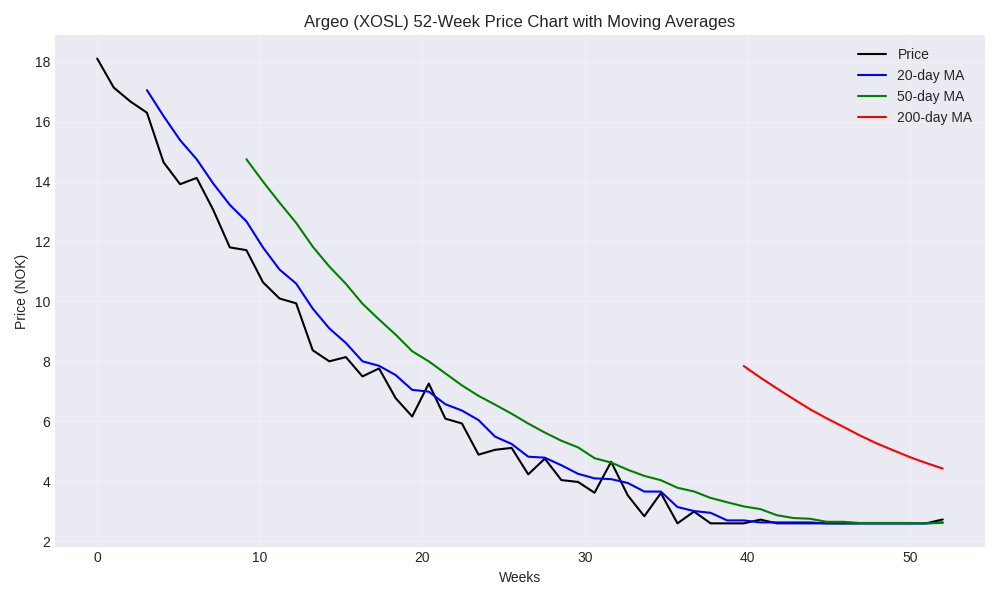

Technical Analysis

Price Performance

Price Summary

| Current Price | 2.73 NOK |

| 52-Week High | 18.10 NOK |

| 52-Week Low | 2.60 NOK |

| 1-Day Change | 1.11% |

| 1-Month Change | -29.64% |

| 3-Month Change | -59.56% |

| 6-Month Change | -78.90% |

| 1-Year Change | -84.01% |

Technical Indicators

Key Technical Signals

- Oversold conditions suggest potential short-term bounce

- Bearish trend with price below both 50-day and 200-day moving averages

- RSI is currently 21.64, indicating Oversold conditions with a Downward trend.

- MACD is currently Bearish with the MACD line at -0.4780 and signal line at -0.4750.

- Price is currently Between bands. Bollinger Band width is 0.6725, indicating high volatility.

Moving Averages

| Indicator | Value | Relation to Price |

|---|---|---|

| 20-Day MA | 3.32 | -17.73% |

| 50-Day MA | 4.29 | -36.35% |

| 200-Day MA | 9.02 | -69.75% |

Support & Resistance Levels

Support Levels

- 2.60 NOK

- 2.68 NOK

Resistance Levels

- 4.45 NOK

- 3.93 NOK

Technical Outlook

| Timeframe | Outlook |

|---|---|

| Short-term | Bullish |

| Medium-term | Bearish |

| Long-term | Bearish |

| Overall Rating | Neutral |

News & Market Sentiment

Recent News

| Date | Title | Summary | Sentiment |

|---|---|---|---|

| May 15, 2025 | Argeo Reports Q1 2025 Financial Results | Argeo reported Q1 2025 revenue of USD 11.5 million, a 21% year-over-year increase. However, EBITDA was negative at USD -0.2 million, down from USD 2.9 million in Q1 2024. | Mixed |

| May 19, 2025 | Joost Bakker Appointed as New Interim CEO of Argeo | Argeo announced the appointment of Joost Bakker as new interim Chief Executive Officer (CEO). Bakker previously served as the company's Chief Operating Officer (COO). | Neutral |

| March 28, 2025 | Argeo Secures New Contracts in South America and Africa | Argeo has secured contract work for two vessels: Argeo Venture and Argeo Searcher. The contracts cover operations in South America and Africa, with work commencing immediately. | Positive |

Market Sentiment

Overall Sentiment

Cautiously Positive

Analyst Ratings

- Consensus: Strong Buy (Price Target: 14.00 NOK)

Social Media Sentiment

Limited social media data available, but investor forums indicate mixed sentiment with optimism about revenue growth counterbalanced by concerns about continued losses and project delays in marine minerals and wind segments.

Sentiment Analysis

Investors show cautious optimism about Argeo's revenue growth (21% YoY in Q1 2025), but concerns remain about profitability as the company reported negative EBITDA. The stock has experienced volatility, with recent price performance showing mixed signals.

Industry Trends

The subsea services sector is showing growth potential with the global subsea system market expected to grow from $12.2 billion (2022) to $19.92 billion (2031) at a CAGR of 5.6%.

Key Industry Trends

- Autonomous Underwater Vehicles (AUVs)

Positive - Argeo specializes in AUV technology, positioning it well to capitalize on this growing trend in ocean mapping and subsea services. - Collaborative Ocean Mapping Initiatives

Positive - Increasing partnerships and data sharing in seafloor mapping align with Argeo's strategic alliance with Shearwater. - Sustainable Blue Economy Development

Positive - Argeo's focus on marine minerals positions it to benefit from growing interest in sustainable resource extraction. - Softening Investor Confidence in Wind Projects

Negative - May impact Argeo's diversification efforts in the renewables sector.

Ongoing Projects

| Project | Status | Expected Completion | Potential Impact |

|---|---|---|---|

| South America ROV & AUV Support Vessel Contract | Active | Four-year contract, ongoing | Significant positive impact on revenue stability and long-term growth |

| Africa AUV Survey Projects | Active | Early June 2025 | Moderate positive impact on short-term revenue |

| TotalEnergies Venus Namibia Project | Completed | Completed March 14, 2025 | Already contributed to Q1 2025 revenue |

| Marine Minerals Deep-Sea Solution Development | Ongoing with delays | Late 2025 (estimated) | Potential long-term growth driver if successful, but facing current delays |

Investment Recommendation

Recommendation Summary

Argeo presents a high-risk, potentially high-reward investment opportunity. The company shows strong revenue growth and operates in expanding markets with significant technological advantages. However, ongoing profitability challenges, negative cash flow, and recent stock price weakness present substantial risks. The current price near 52-week lows and oversold technical indicators suggest a potential value opportunity for investors with appropriate risk tolerance and medium to long-term investment horizons. A staged entry approach with strict risk management is recommended given the mixed signals across financial, technical, and market factors.

Action

Hold with cautious accumulation on dips

Conviction

Moderate

Timeframe

Medium to Long-term (6-18 months)

Confidence Score

6/10

Price Targets

Optimal Timing

Entry: Current price levels represent potential value entry points given the oversold RSI (21.64) and proximity to 52-week lows

Exit: Upon reaching resistance levels or following significant positive catalysts such as improved profitability metrics

Catalysts to Watch

- Q2 2025 financial results (watch for EBITDA improvement)

- New contract announcements building on recent South America and Africa deals

- Progress updates on ongoing projects

- Stabilization of leadership following recent changes

- Developments in marine minerals market

Supporting Rationale

Financial Factors

- Strong revenue growth (430% YoY in 2024, 21% YoY in Q1 2025)

- Significant backlog of USD 164 million indicating future revenue stability

- Attractive valuation metrics (P/S ratio of 0.23-0.43 vs peer average of 2.7x)

- Concerning negative EBITDA (USD -0.2 million in Q1 2025)

- Ongoing net losses (USD 4.2 million in Q1 2025)

- Negative free cash flow suggesting continued capital requirements

Technical Factors

- Oversold RSI (21.64) suggesting potential for short-term rebound

- Price near 52-week lows (2.60-2.70 NOK vs 52-week range of 2.60-18.25 NOK)

- Bearish medium and long-term trends with price below both 50-day and 200-day moving averages

- High volatility indicated by Bollinger Band width (0.6725)

- Increasing trading volume (20-day average of 826,212 shares vs overall average of 401,272)

- Clear support levels at 2.60 and 2.68 NOK

News & Sentiment Factors

- Cautiously positive overall market sentiment

- Strong analyst consensus rating (Strong Buy with 14.00 NOK price target)

- Recent positive developments with new contracts in South America and Africa

- Leadership transition creating uncertainty but potential for fresh strategic direction

- Successful completion of complex projects (TotalEnergies Venus Namibia)

Market Trend Factors

- Growing subsea system market (projected CAGR of 5.6% from 2022-2031)

- Positive positioning in AUV technology aligning with industry trends

- Strategic alliances supporting collaborative ocean mapping initiatives

- Potential benefits from sustainable blue economy development

- Possible headwinds from softening investor confidence in wind projects

- Geographical diversification across multiple regions

Alternative Scenarios

| Scenario | Probability | Impact | Recommended Action |

|---|---|---|---|

| Accelerated profitability improvement | Low to Moderate | Significant positive price movement toward 14.00 NOK analyst target | Increase position size and adjust exit targets upward |

| Continued financial deterioration | Moderate | Further price decline below support levels | Exit position if stop loss is triggered |

| Strategic acquisition or partnership | Low | Potential significant positive revaluation | Maintain position and reassess based on terms of any deal |

Risk Assessment

Risk Level

HighKey Risks

- Continued profitability challenges with negative EBITDA and net losses

- Significant stock price decline (-82.75% over past year, -53.18% over past month)

- Negative free cash flow requiring potential additional financing

- Leadership transition potentially affecting strategic execution

- Supply chain challenges and equipment failures

- Internal control weaknesses noted in annual reporting

- Market volatility in core sectors

Mitigating Factors

- Strong revenue growth trajectory

- Substantial project backlog providing revenue visibility

- Technological innovation with 5 patents submitted

- Diversified operations across oil & gas, marine minerals, and renewables

- Strategic positioning in growing subsea services market

- Attractive valuation relative to peers